This web page comes in ~6 parts:

- Gold Overview & My Commentary

- Continually Updated Article & Analysis Feed

- Contact & Websites For Gold Experts Claudio Grass & Alasdair Macleod

- All My Videos On The Subjects Of: Gold, Hard Money, Finance, Economics etc

- Viewer Q&A

- Regulated & Recommended Bullion Dealers

***

Gold – Some Questions Answered

https://godfreybloom.uk/wp-content/uploads/2023/10/Gold-Some-Questions-Answered.pdf

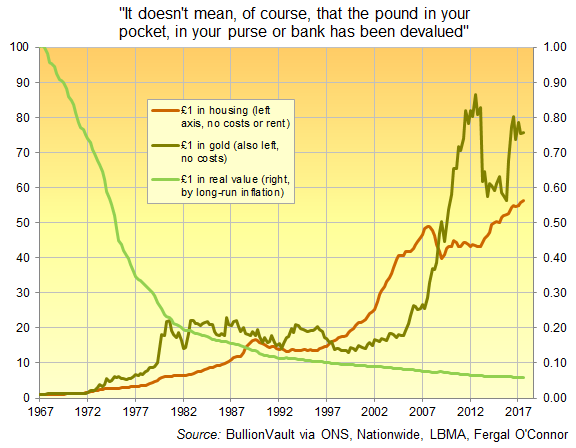

Gold has been money for 5000 years. Quite a provenance. The reason is that it does not decay physically or monetarily.

As I always point out to undergraduates: a gold sovereign would buy you bed & breakfast in a good London, Paris or New York hotel 150 years ago – and it would buy the same today, and will in another 150 years.

Historically paper money is a new invention, with a very sorry provenance.

In 1971 the United States came off the gold standard (currency backed by gold) to fund the Vietnam war with printed currency. The result was a fall in the purchasing power of the dollar against gold by 94%.

Similarly this has happened to all other global paper currencies.

Paper money is simply a credit note by a bank – underwritten by politicians. Its value degrades with corruption. Just remember what you paid for a pint of beer or family car 20 years ago.

But remember gold is not an investment. It is a preserver of wealth as the hotel analogy shows. Thus gold coins are for people who want to seal in the spending power of their savings for the long term.

It is not a reasonable or recommended move to buy & sell Gold coins over the short term (trading). Buying & selling fees at most dealers, especially for smaller amounts, make this an unviable option – you will just lose money.

It helps when dealing to know what coins or bullion you need & an idea of the amount you want to spend.

Remember: Gold Sovereigns (Coins) in the UK are Capital Gains Tax & VAT Exempt. They are classed as Coin Of The Realm.

Silver coins are not treated the same – with silver coins, VAT is charged at 20% if you take delivery. So you have to hope for a 20% upward movement just to break even (not including potential selling fees or spread)!

When buying Gold Coins remember the golden rules:

- Find a reputable dealer, perform your own due diligence after comparing many dealers.

- Check the buy/sell price on offer.

- Take delivery if you can. If you cannot, use a reputable safe deposit house. There will be one in your nearest big town.

- Buy coins for bullion value & tax benefits, not collectability.

- Don’t trade (buy/sell in the short term), they are for the long haul, be patient.

- Stick to WHOLE SOVEREIGNS, HALF SOVEREIGNS, or BRITANNIAS no others.

- Contact me if you have any questions.

Buying & selling gold is very easy.

Different dealers have different minimum buy requirements.

In general, bigger purchases give a better overall price.

Larger purchases require ID protocols, a regulatory requirement, but are standard practice and nothing to worry about.

Due to recent unprecedented Gold demand; Gold deliveries from all dealers may be slightly delayed, this does not affect the buying/strike price.

See my videos on the topic for more information below.

Comments as always are welcome. Please use my contact page to reach me if you have any questions and I will add to the Q&A Section below.

Cutting Edge & Important Articles

- THE GREAT & THE GOOD CATCH UP WITH ME!

https://www.honestmoneyinitiative.com/watch/ - Safe Haven Gold Demand To Disrupt The FED’s Risky $1.784 Trillion Lifeline (Nov 3 2023)

https://youtu.be/ZylNkz_flpw?si=xjeyungyDROHxyh9 - Simon Hunt: Global Weather: Why it will help Define the Coming Economic Cycle (Oct 2023)

https://godfreybloom.uk/wp-content/uploads/2023/10/Thought-for-the-Day-Global-Weather-Why-it-will-help-Define-the-Coming-Economic-Cycle.pdf - Basel III Breakdown (Oct 20 2023)

Heavy going, my breakdown:

https://godfreybloom.uk/wp-content/uploads/2023/10/basel-3-breakdown.txt

https://www.youtube.com/watch?v=ZMAwDI46pFw

Supporting Articles & Material

- Goldmoney Research Homepage – Alasdair MacLeod

https://www.goldmoney.com/research

Gold Switzerland Homepage – Egon Von Greyerz

https://goldswitzerland.com/

Precious Metal Advisory In Switzerland – Claudio Grass

https://claudiograss.ch - Polish Central Bank Buys Gold According To Secret EU Plan (6 Dec 2023)

https://thegoldobserver.substack.com/p/polish-central-bank-buys-gold-according?publication_id=100818&post_id=139513535 - Central Banks Are Buying Gold At A Torrid Pace (Dec 2023)

https://kingworldnews.com/sprott-central-banks-maintain-torrid-buying-of-gold/ - The Fed Will Revalue Gold In 2024 (Nov 17 2023)

https://www.youtube.com/watch?v=jh0QxTF2hes - Dutch Central Bank Admits It Has Prepared For a New Gold Standard (Nov 19 2023)

https://thegoldobserver.substack.com/p/dutch-central-bank-admits-it-has - Gold Demand Trends Q3 2023 (Oct 31 2023)

https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-q3-2023 - A Brief History Of The Gold Standard – Alasdair Macleod (Sept 2023)

https://www.goldmoney.com/research/a-brief-history-of-the-gold-standard - Gold Is Exposing The Myth Of Deflation In Japan

https://www.youtube.com/watch?v=d42KPn3rZZw - The Swiss Franc’s “Phenomenal” Bull Run (Sept 2023)

https://going-postal.com/2023/09/the-swiss-francs-phenomenal-bull-run/ - Constructive & Destructive Roles Of Credit

https://schiffgold.com/commentaries/constructive-and-destructive-roles-of-credit/ - Don’t Rely On GDP

https://schiffgold.com/commentaries/dont-rely-on-gdp/ - Central Bank Gold Buying Continued To Sizzle In August

https://www.zerohedge.com/markets/central-bank-gold-buying-continued-sizzle-august - Unwinding The Financial System

https://schiffgold.com/commentaries/unwinding-the-financial-system/ - The End Of The Road For The Dollar

https://schiffgold.com/commentaries/the-end-of-the-road-for-the-dollar/ - There’s A Herd Of Elephants In The Room

https://schiffgold.com/commentaries/theres-a-herd-of-elephants-in-the-room/ - Say’s Law Says It All

Heavy going but the fundamental point is that fiat currency is international policy.

https://www.goldmoney.com/research/says-law-says-it-all - Dollar Hegemony Ending Due To Geopolitical Changes

https://mises.org/wire/dollar-hegemony-ending-due-geopolitical-changes - Biden Retiring The Dollar?

https://pro.paradigmnewsletters.org/p/awn_bidenbuckstac_1022/LAWNZ813/?h=true - German Central Bank Gold Revaluation Account

https://www.zerohedge.com/commodities/german-central-bank-gold-revaluation-account-underlines-soundness-balance-sheet - China Buys 23 Tons Of Gold In 9th Straight Month Of Purchases – Total: 2137 Tons

https://www.zerohedge.com/commodities/china-buys-23-tons-gold-9th-straight-month-purchases-total-rises-record-2137-tons - Keeping Your Head Amidst Debt Blind Madness

https://goldswitzerland.com/keeping-your-head-amidst-debt-blind-madness/ - Inflation Will Return

https://www.goldmoney.com/research/inflation-will-return-july-2023 - The People’s Bank Of China Manipulates The Shanghai Gold Exchange Gold Price

https://thegoldobserver.substack.com/p/the-pboc-manipulates-the-sge-gold - Which Assets Perform Well In Recessions

https://goldswitzerland.com/recession-ante-portas-which-assets-perform-well-in-recessions/ - Despite Declining Price – Gold Is Strengthening

https://thegoldobserver.substack.com/p/despite-declining-price-gold-is-strengthening - Geopolitical Evolution

https://www.goldmoney.com/research/geopolitical-evolution-2023 - BRICS: The West Tries Playing Catch Up But It Is Too Late

https://english.almayadeen.net/articles/opinion/brics:-the-west-tries-playing-catch-up-but-its-too-late - Updating Say’s Law For Modern Times

https://www.goldmoney.com/research/updating-say-s-law-for-modern-times - The Commercial Real Estate Tsunami Just Shifted Into Another Gear

https://www.lewrockwell.com/2023/06/michael-snyder/the-commercial-real-estate-tsunami-just-shifted-into-another-gear/ - Become Smarter Than The Policy Makers – Become Your Own Gold-Backed Bank

https://goldswitzerland.com/think-smarter-than-the-policy-makers-become-your-own-gold-backed-bank/ - Inflation Is Not An Act Of God – Godfrey Bloom & Claudio Grass

https://claudiograss.ch/2023/06/inflation-it-is-not-an-act-of-god/

https://www.youtube.com/watch?v=cccnI10YfCg - Front Running The Fed: How Gold & Chess Players Beat a Rigged Market

https://goldswitzerland.com/front-running-the-fed-how-gold-chess-players-beat-a-rigged-market/ - Winston Churchill’s Gold Standard Folly

https://fee.org/articles/winston-churchill-s-gold-standard-folly/?utm_source=email&utm_medium=email&utm_campaign=2020_FEEDaily - Sterling Crisis Ahead!

https://www.goldmoney.com/research/sterling-crisis-ahead - The Dangerous Direction Of Fed-Speak & Fed-Policy

https://goldswitzerland.com/facts-vs-fed-speak-a-comical-history-with-tragic-consequences/ - Gold’s Key Indicator

https://goldswitzerland.com/golds-key-indicator/ - Death Of The US Dollar & The Rise Of Gold

https://goldswitzerland.com/piepenburg-macleod-death-of-the-us-dollar-and-the-rise-of-gold/ - Dollar Woes & Debt Denial – The USA Is Screwed

https://goldswitzerland.com/dollar-woes-to-debt-denial-the-usa-is-screwed/ - Why Are ?Banks Buying Up All Of The Gold?

https://www.youtube.com/watch?v=Q-5GORxIJPI - Insights On The Rotten State Of The Banking System – Egon Von Greyerz & Alasdair MacLeod

https://goldswitzerland.com/von-greyerz-macleod-insights-on-the-rotten-state-of-the-banking-system/ - De-Dollarisation Kicks Into High Gear

https://www.lewrockwell.com/2023/04/no_author/de-dollarization-kicks-into-high-gear/ - Forecasting The Gold Price Is A Mug’s Game

https://goldswitzerland.com/forecasting-the-gold-price-is-a-mugs-game/ - US Bank Trouble Heralds The End Of The Dollar Reserve System

https://www.zerohedge.com/geopolitical/us-bank-trouble-heralds-end-dollar-reserve-system - A Bank is a Bank, is a Bank – Parts 1 & 2 – Claudio Grass

https://claudiograss.ch/2023/04/a-bank-is-a-bank-is-a-bank/

https://claudiograss.ch/2023/04/a-bank-is-a-bank-is-a-bank-2/ - How Quickly Will The Dollar Collapse? – Alasdair MacLeod

https://www.goldmoney.com/research/how-quickly-will-the-dollar-collapse-2023 - The Great Credit Unwind Pivot – Alasdair MacLeod

Important Technical Briefing

https://www.goldmoney.com/research/the-great-credit-unwind-pivot - Banking Crisis: The New Bailout Strategy

https://claudiograss.ch/2023/03/banking-crisis-the-new-bailout-strategy-2/ - In The End, The $ Goes To 0 And The US Defaults – Egon Von Greyerz

https://goldswitzerland.com/in-the-end-the-goes-to-zero-and-the-us-defaults/ - The Lost World Of The Barbarous Relic

https://www.lewrockwell.com/2022/12/george-f-smith/the-lost-world-of-the-barbarous-relic/ - The Debate Between Gold & Bitcoin In 2023

Needs reading twice, even for the professional.

https://godfreybloom.uk/wp-content/uploads/2023/02/2022.12.08-The-debate-between-gold-and-bitcoin-in-2023.pdf - Gold In 2023 – Alasdair MacLeod

https://godfreybloom.uk/wp-content/uploads/2023/02/2022.12.29-Gold-in-2023.pdf - The Benefits Of A Savings Culture – Alasdair MacLeod

https://godfreybloom.uk/wp-content/uploads/2023/02/2023.01.04-Benefits-of-a-saving-culture.pdf - As West Debts & Stocks Implode, East Gold & Oil Explode – Egon Von Greyerz

https://goldswitzerland.com/as-west-debt-stocks-implode-east-gold-oil-will-explode/ - Goldmoney Insight: A Tale Of 2 Worlds – Alasdair Macleod

The West’s Monetary Decline – While China & Russia Accumulate Enough Gold To Implement A Gold Standard

https://godfreybloom.uk/wp-content/uploads/2023/02/2023.02.02-A-tale-of-two-worlds.pdf - Goldmoney Insight: Money & Recession – Alasdair Macleod

https://godfreybloom.uk/wp-content/uploads/2023/02/2023.02.10-Money-and-recession.pdf - Legal Definitions Of Money & Credit – Alasdair Macleod

Definitive History Of Gold – Straight Off The Shelf

https://www.goldmoney.com/research/legal-definitions-of-money-and-credit - Gold’s Climb Amidst Wisdom’s Decline – Egon Von Greyerz

https://goldswitzerland.com/golds-climb-amidst-wisdoms-decline/ - Why Gold Has Out Performed The S&P 500 Over The Past 20 Years

https://www.investing.com/analysis/why-gold-has-outperformed-the-sp-500-over-the-past-20-years-200589411 - The $2.5 Quadrillion Disaster Waiting To Happen – Egon Von Greyerz

https://goldswitzerland.com/2-5-quadrillion-disaster-waiting-to-happen-egon-von-greyerz/ - Gold & Silver Charts

https://kingworldnews.com/frustrated-with-gold-silver-check-out-these-remarkable-gold-silver-charts/ - The Upside Down World Of Currency – Alasdair Macleod

Technical – Needs reading twice for the layman.

https://www.goldmoney.com/research/the-upside-down-world-of-currency - Top 3 Outcomes As The Elites Try To Reset The World Monetary System (Caution: Speculative)

https://www.lewrockwell.com/2022/10/no_author/the-top-3-outcomes - Goldmoney Insight: Imploding Credit – The Consequences

A very comprehensive historical guide to gold – by Alasdair Macleod, Head of Gold Money Research. Well worth the time to read it before buying gold.

https://godfreybloom.uk/wp-content/uploads/2022/10/2022.10.06-Imploding-credit.pdf - There Is Going To Be A New World Disorder – Egon Von Greyerz

https://goldswitzerland.com/there-is-going-to-be-a-new-world-disorder/ - Credit Suisse & USD Policy: Signposts of Systemic Implosion to Gold Explosion – Egon Von Greyerz

https://goldswitzerland.com/credit-suisse-usd-policy-signposts-of-systemic-implosion-to-gold-explosion/ - World Dollar Hegemony Is Ending – Patrick Barron

https://going-postal.com/2022/10/world-dollar-hegemony-is-ending/ - Inflation – The Hidden Tax

https://twitter.com/steve_hanke/status/1578197919857008640?s=20&t=PTb8T420eea5WRIB4KPSaA - Gold About To Make New Highs In GBP Terms

https://twitter.com/TaviCosta/status/1574245574332645376?s=20&t=jkaz_52zB22H2v3y7IAL0Q - The Economy Had To Be Shut Down – Inflation Rates By Country

https://twitter.com/SimonElmer2022/status/1581633608552284160?s=20&t=UY8_ZnA-s4cWsJ73GIwG0A

Experts Claudio Grass & Alasdair Macleod

Claudio Grass runs precious metals advisory in Switzerland and has been a good friend of mine for many years.

You can contact him here for personally recommended large holding precious metal advisory.

claudiograss.ch

Alasdair has been a chum of mine for many, many years and I look to him for top notch expert analysis on anything Gold.

You can find his Substack here, and other work below.

Goldmoney Research

Twitter / X

My Videos On Gold, Inflation, Currency & More

Q & A Section

- Premium Bonds:

Premium Bonds are a loan to the UK government. In place of a coupon (interest) they put the yield into a reserve & distribute that reserve in prizes.

The current yield is circa 4% (10 years).

Are they safe? Safer than banks yes.

But with REAL inflation at circa 11% your investment must drop by 11%-4%=7% year on year.

So a premium bond holder in the medium long term must lose.

A bit like the casino roulette wheel, eventually the house wins.

Remember, Gordon Brown sold your gold holdings in the late 1990s at $250 per ounce – I was buying. - Silver:

I hold plenty but it is an industrial as well as monetary metal.

The ride is bumpy therefore, it looks cheap today, but I thought it was a steal at $25 per ounce! Ouch !

Given VAT at 20% if you take delivery – and a current 10%-15% premium, it is simply an unrealistic choice for investment – you will need a 35% move upward to simply break even. Scrap Silver or buying coins peer-to-peer could be options, but its a buy only for the brave – and you must do your due diligence on the latter matters. Gold first.

LBA Regulated Gold Dealers

IF YOU HAVE ANY CONCERNS OR COMPLAINTS ABOUT THESE RECOMMENDED BULLION DEALERS – PLEASE LET ME KNOW DIRECTLY VIA MY CONTACT PAGE

Gold Bullion Partners

My recommended Premium Service.

Introduction video: https://youtu.be/-h3v5BLsbVw

The Pure Gold Company

Speak to my trusted broker Dan Alderman.

R C Baird & Co

Bullion by Post

Gold.co.uk

This page only recommends institutions after a due diligence procedure however it is not infallible. It is imperative you perform your own due diligence and as much personal research on all aspects of Gold Purchase as possible.

PLEASE BE AWARE – Banks are not your friend when you want to buy Gold, Silver, Bitcoin or anything which takes YOUR money from THEIR grasp. Be under no illusion that they will employ many tactics, including lies & threats to put you off Gold/Metal purchase – especially when dealing with larger sums.

For the smoothest transaction, and to keep your private activity with your money away from the notice of your bank – I have worked with colleagues to provide a simple work around – to allow your money to go where it needs to with minimal headache – found here.